Dec. 31 Wages Expense 5,500

Wages Payable 5,500

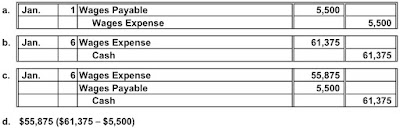

a. Journalize the reversing entry that would be made on January 1 of the next period.

b. Assume that the first paid period of the following year ends on January 6 and that wages of $61,375 were paid. Journalize the entry to record the payment of the January 6 wages.

c. Journalize the entry to record the payment of the January 6 wages assuming that a reversing entry was not made on January 1.

d. What is wages expense for the period January 1–6?

Answers:

a. Jan. 1 Wages Payable5,500

Wages Expense5,500

b. Jan. 6 Wages Expense61,375

Cash61,375

c. Jan. 6 Wages Expense55,875

Wages Payable5,500

Cash61,375

d. $55,875 ($61,375 – $5,500)