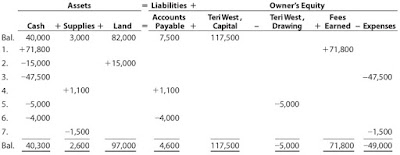

Assets 5 Liabilities 1 Owner’s Equity

Cash 1 Supplies 1 Land 5

Accounts

Payable 1

Teri West ,

Capital −

Teri West ,

Drawing 1

Fees

Earned − Expenses

Bal. 40,000 3,000 82,000 7,500 117,500

1. +71,800+71,800

2. –15,000 +15,000

3. –47,500−47,500

4. +1,100 +1,100

5. –5,000–5,000

6. –4,000 –4,000

7. –1,500–1,500

Bal. 40,300 2,600 97,000 4,600 117,500 –5,000 71,800 –49,000

a. Describe each transaction.

b. What is the amount of the net increase in cash during the month?

c. What is the amount of the net increase in owner’s equity during the month?

d. What is the amount of the net income for the month?

e. How much of the net income for the month was retained in the business?

Answers:

a.

(1) Provided catering services for cash, $71,800.

(2) Purchase of land for cash, $15,000.

(3) Payment of cash for expenses, $47,500.

(4) Purchase of supplies on account, $1,100.

(5) Withdrawal of cash by owner, $5,000.

(6) Payment of cash to creditors, $4,000.

(7) Recognition of cost of supplies used, $1,500.

b. $300 ($40,300 – $40,000)

c. $17,800 (–$5,000 + $71,800 – $49,000)

d. $22,800 ($71,800 – $49,000)

e. $17,800 ($22,800 – $5,000)