a. Journalize the adjusting entry required as of December 31.

b. If the adjusting entry in (a) were omitted, which items would be erroneously stated on (1) the income statement for the year and (2) the balance sheet as of December 31?

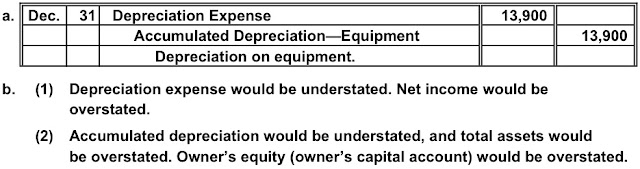

Answers:

a. Dec. 31 Depreciation Expense13,900

Accumulated Depreciation—Equipment 13,900

Depreciation on equipment.

b. (1) Depreciation expense would be understated. Net income would be

overstated.

(2) Accumulated depreciation would be understated, and total assets would

be overstated. Owner’s equity (owner’s capital account) would be overstated.