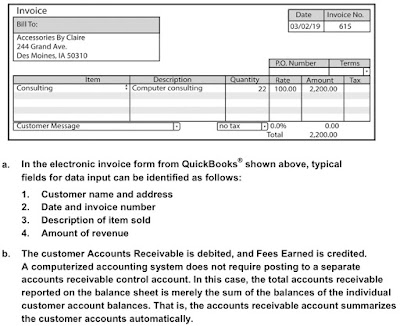

Most computerized accounting systems use electronic forms to record transaction information, such as the invoice form illustrated at the top of Exhibit 7 in this chapter.

a. Identify the key input fields (spaces) in an electronic invoice form.

b. What accounts are posted from an electronic invoice form?

c. Why aren’t special journal totals posted to control accounts at the end of the month in an electronic accounting system?

Answer:

a. In the electronic invoice form from QuickBooks

fields for data input can be identified as follows:

1. Customer name and address

2. Date and invoice number

3. Description of item sold

4. Amount of revenue

b. The customer Accounts Receivable is debited, and Fees Earned is credited.

A computerized accounting system does not require posting to a separate

accounts receivable control account. In this case, the total accounts receivable

reported on the balance sheet is merely the sum of the balances of the individual

customer account balances. That is, the accounts receivable account summarizes

the customer accounts automatically.

c. Controlling accounts are not posted at the end of the month in a computerized

accounting system. Transactions are recorded through data input into electronic

forms, into electronic special journals, or for infrequent transactions, by an

electronic general journal. Balances of affected accounts are automatically posted

and updated from the information recorded on the form. If desired, the computer

can provide a printout of the monthly transaction history for a particular account,

which provides the same information as a journal. In addition, the controlling

account is not posted separately. In a manual system, separate posting to the

controlling account provides additional control by reconciling the controlling

account balance against the sum of the individual customer account balances.

However, in a computerized accounting system, there are no separate postings to

a controlling account because the computer is not going to make posting or

mathematical errors. Therefore, there is no need for the additional control provided

by posting a journal total to a controlling account.