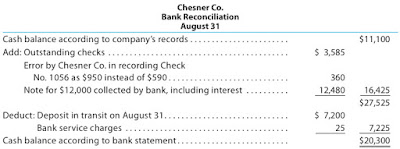

An accounting clerk for Chesner Co. prepared the following bank reconciliation:

Chesner Co. Bank Reconciliation August 31 Cash balance according to company’s records . . . . . . . . . . . . . . . . . . . . . . . $11,100 Add: Outstanding checks . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 3,585

Error by Chesner Co. in recording Check No. 1056 as $950 instead of $590 . . . . . . . . . . . . . . . . . . . . . . . . . . . . 360 Note for $12,000 collected by bank, including interest . . . . . . . . . . 12,480 16,425 $27,525 Deduct: Deposit in transit on August 31. . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 7,200 Bank service charges . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 25 7,225 Cash balance according to bank statement . . . . . . . . . . . . . . . . . . . . . . . . . . $20,300

a. From the data in this bank reconciliation, prepare a new bank reconciliation for Chesner Co., using the format shown in the illustrative problem.

b. If a balance sheet is prepared for Chesner Co. on August 31, what amount should be reported for cash?

Answer:

a. Cash balance according to bank statement$20,300 Add deposit in transit on August 317,200 Deduct outstanding checks3,585 Adjusted balance$23,915 Cash balance according to company’s records$11,100 Add: Error in recording Check No. 1056 as $950 instead of $590$ 360 Note for $12,000 collected by bank, including interest12,480 12,840 Deduct bank service charges25 Adjusted balance$23,915 b.$23,915