Shore Co. sold merchandise to Blue Star Co. on account, $112,000, terms FOB shipping point, 2/10, n/30. The cost of the merchandise sold is $67,200. Shore Co. paid freight of $1,800. Journalize the entries for Shore Co. and Blue Star Co. for the sale, purchase, and payment of amount due. Assume all discounts are taken.

Answer:

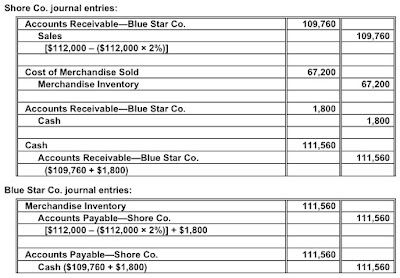

Shore Co. journal entries: Accounts Receivable—Blue Star Co. 109,760 Sales 109,760 [$112,000 – ($112,000 × 2%)]

Cost of Merchandise Sold 67,200 Merchandise Inventory 67,200 Accounts Receivable—Blue Star Co. 1,800 Cash 1,800 Cash 111,560 Accounts Receivable—Blue Star Co. 111,560 ($109,760 + $1,800) Blue Star Co. journal entries: Merchandise Inventory 111,560 Accounts Payable—Shore Co. 111,560 [$112,000 – ($112,000 × 2%)] + $1,800 Accounts Payable—Shore Co. 111,560 Cash ($109,760 + $1,800) 111,560