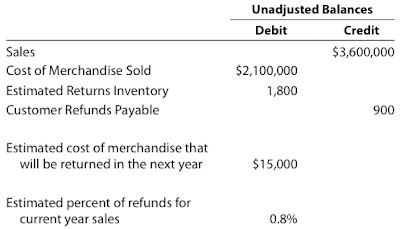

Assume the following data for Lusk Inc. before its year-end adjustments:

Unadjusted Balances Debit Credit Sales $3,600,000 Cost of Merchandise Sold $2,100,000 Estimated Returns Inventory 1,800 Customer Refunds Payable900

Estimated cost of merchandise that will be returned in the next year $15,000

Estimated percent of refunds for current year sales 0.8%

Journalize the adjusting entries for the following:

a. Estimated customer allowances

b. Estimated customer returns

Answer:

a.

Sales ($3,600,000 × 0.008)28,800

Customer Refunds Payable 28,800

b.

Estimated Returns Inventory 15,000

Cost of Merchandise Sold 15,000