Financial statement data for years ending December 31 for Chiro-Solutions Company follow:

20Y2 | 20Y1

Sales $2,912,000 | $2,958,000

Accounts receivable:

Beginning of year 300,000 | 280,000

End of year 340,000 | 300,000

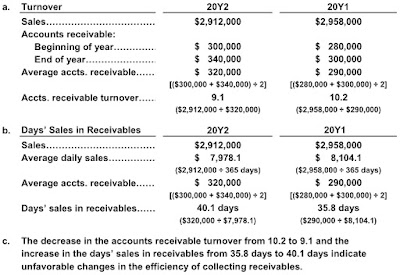

a. Determine the accounts receivable turnover for 20Y2 and 20Y1.

b. Determine the days’ sales in receivables for 20Y2 and 20Y1. Use 365 days and round to one decimal place.

c. Does the change in accounts receivable turnover and the days’ sales in receivables from 20Y1 to 20Y2 indicate a favorable or unfavorable change?

Answer:

a. Sales.................................... Accounts receivable: Beginning of year............... End of year........................ Average accts. receivable...... Accts. receivable turnover...... b. Sales.................................... Average daily sales............... Average accts. receivable...... Days’ sales in receivables...... 9.1 [($280,000 + $300,000) ÷ 2] 10.2 $ 290,000 [($300,000 + $340,000) ÷ 2] $ 340,000 $ 300,000 $ 320,000 $ 320,000 $ 290,000 $ 7,978.1 $ 8,104.1 ($2,912,000 ÷ 365 days) ($2,958,000 ÷ 365 days) ($320,000 ÷ $7,978.1) ($290,000 ÷ $8,104.1) c. The decrease in the accounts receivable turnover from 10.2 to 9.1 and the increase in the days’ sales in receivables from 35.8 days to 40.1 days indicate unfavorable changes in the efficiency of collecting receivables.