Tech Support Services Unadjusted Trial Balance January 31, 2019 Debit Balances Cash . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 25,550 Accounts Receivable. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 44,050 Supplies . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6,660 Prepaid Insurance . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3,600 Equipment. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 162,000 Notes Payable. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 75,000 Accounts Payable . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13,200 Thad Engelberg, Capital . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 101,850 Thad Engelberg, Drawing . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 33,000 Fees Earned. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 534,000 Wages Expense . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 306,000 Rent Expense . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 62,550 Advertising Expense. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 23,850 Gas, Electricity, and Water Expense . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17,000 684,260 724,050

The debit and credit totals are not equal as a result of the following errors:

a. The cash entered on the trial balance was overstated by $8,000.

b. A cash receipt of $4,100 was posted as a debit to Cash of $1,400.

c. A debit of $12,350 to Accounts Receivable was not posted.

d. A return of $235 of defective supplies was erroneously posted as a $325 credit to Supplies.

e. An insurance policy acquired at a cost of $3,000 was posted as a credit to Prepaid Insurance.

f. The balance of Notes Payable was overstated by $21,000.

g. A credit of $3,450 in Accounts Payable was overlooked when the balance of the account was determined.

h. A debit of $6,000 for a withdrawal by the owner was posted as a debit to Thad Engelberg, Capital.

i. The balance of $28,350 in Advertising Expense was entered as $23,850 in the trial balance.

j. Miscellaneous Expense, with a balance of $4,600, was omitted from the trial balance.

Instructions

1. Prepare a corrected unadjusted trial balance as of January 31, 2019.

2. Does the fact that the unadjusted trial balance in (1) is balanced mean that there are no errors in the accounts? Explain.

Answer:

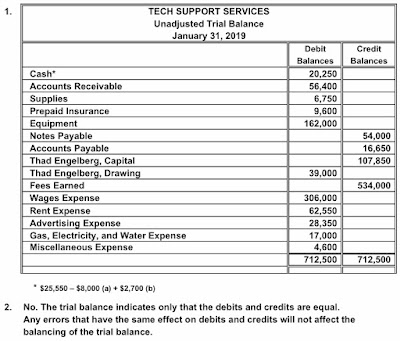

1.

Cash*20,250

Accounts Receivable56,400

Supplies6,750

Prepaid Insurance9,600

Equipment162,000

Notes Payable54,000

Accounts Payable16,650

Thad Engelberg, Capital107,850

Thad Engelberg, Drawing39,000

Fees Earned534,000

Wages Expense306,000

Rent Expense62,550

Advertising Expense28,350

Gas, Electricity, and Water Expense 17,000

Miscellaneous Expense4,600

* $25,550 – $8,000 (a) + $2,700 (b)

2. No. The trial balance indicates only that the debits and credits are equal.

Any errors that have the same effect on debits and credits will not affect the

balancing of the trial balance.